At this week’s Spending Affordability Committee meeting, the Maryland Department of Legislative Services (DLS) said fiscal 2024 is projected to end with a fund balance of $528 million, with ongoing revenues exceeding ongoing spending by $125 million.

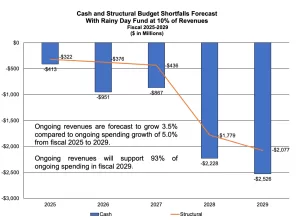

A $413 million structural deficit is anticipated for fiscal 2025. Structural challenges continue for the remainder of the forecast period, culminating in a $2.1 billion deficit in fiscal 2029.

Source: DLS

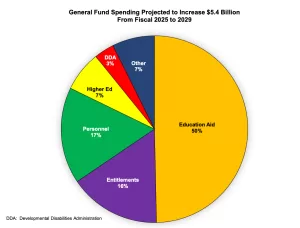

Creating this imbalance is a projected increase in General fund spending of $5.4 billion from fiscal 2025 to 2029 largely attributed to the costs of ongoing K-12 education enhancements outpacing the availability of special funds in the Blueprint for Maryland’s Future Fund, which is dedicated to implementing the Kirwan Commission on Innovation and Excellence in Education’s recommendations. Other factors include entitlement programs, personnel costs, and higher education.

Source: DLS

DLS proposed several long-term and short-term solutions to close this gap leaving some legislators wondering if revenue enhancements are in the near future.

Structural Solutions

Reduce Ongoing Spending to More Closely Align with Ongoing Revenues

- Helps to resolve underlying problems.

- Given the magnitude of out-year challenges, reducing ongoing spending in fiscal 2025 is essential to avoid a fiscal cliff in fiscal 2028.

Enhance Ongoing Revenues to Support Spending Commitments

- It helps to resolve the underlying problem.

- Revenues alone are unlikely to resolve long-term budget problems. For illustrative purposes, closing the fiscal 2029 budget gap entirely with revenues is equivalent to increasing sales tax revenues by 30 percent or individual income tax revenues by 12 percent.

Improve Cash Outlook

Shift PAYGO to Bonds

- Immediate budget relief.

- Capital Debt Affordability Committee debt increase accommodates and is well within affordability ratios.

- A higher debt limit will increase long-term debt service costs.

Draw on Rainy Day Fund Balance for Temporary Budget Relief

- A temporary solution that does not address the structural challenge that mounts over time.

- Drawing balance down when the economy is growing steadily leaves the State vulnerable to the impact of a recession.

- Prior analyses have indicated that a mild recession will result in general fund revenues falling about 10 percent below pre-recession estimates over two years.

- A recession coupled with the projected fiscal cliff in fiscal 2028 would result in ongoing revenues covering only about 88 percent of projected spending.

This briefing, which included members of the General Assembly’s fiscal committees, is the first of two briefings that will occur as members begin to prepare for the 2024 session. A second briefing of the Spending Affordability Committee will be held on December 14. The Committee is tasked with making spending and budget recommendations to provide guidance to the Governor and General Assembly when formulating and approving the budget for the upcoming fiscal year, FY 2025. The Committee is composed of members of the General Assembly and two public members.

Spending Affordability Briefing Document

Maryland Matters Article